In The News

Cook County Second Installment 2024 Property Tax Bills Coming Out Nov. 14

November 2025 -

After months of uncertainty and delay, the Cook County Assessor’s office will be releasing the next property tax bills on Nov. 14, with a due date of Dec. 15. The timing will allow tax payers to include the payments on their annual income tax filings.

See this news story for more.

2,800 Housing Units Proposed for Lincoln Yards Site

September 2025 -

More than a dozen high and mid-rise buildings and 50 townhouses and single-family homes would be added to the northern portion of the Lincoln Yards development site with a plan proposed by JDL Development. The development would also include hotel, office and retail space along with an extension of the Bloomingdale Trail over the Chicago River in Lincoln Park.

If the development is approved by the city, the first phase of the Foundry Park development would begin in about a year. The property has been vacant for years as another developer struggled to move forward with a megadevelopment on the site.

See this Block Club Chicago story for more.

Chicago’s Office Sector Continues to Struggle

August 2025 -

Chicago’s office sector continues to struggle with rising vacancies and negative absorption, according to research from Transwestern, as highlighted in this IL Real Estate Journal story. The firm’s Q2 2025 Chicago CBD office report notes that the vacancy rate rose to a new high of 22.8%. The quarter also saw negative absorption of 541,722 square feet, the eighth consecutive quarter of negative net absorption in the office sector.

Office leasing in the CBD has also slowed, with tenants signing just 35 leases totaling 15,000 square feet during the second quarter. That is a decline from the 55 office leases signed in the CBD during the first quarter of the year.

The largest new lease of the quarter was Golub Capital’s 205,450-square-foot lease at 225 W. Randolph St. in the West Loop. The 850,000-square-foot office tower, known as The Bell, was recently redevelopment.

Retail Store Closings Increase Nationally

July 2025 -

Retail store closures are increasing across the U.S. as leasing activity slows and many retailers struggle with staying in business. According to a Cushman & Wakefield report, leasing has fallen 20% this year compared with 2024.

The downward trend began last year as rising rent and design costs cut into many retailers’ operational costs. Trade uncertainty is now amplifying the pullback and some retailers are delaying decision-making. The highest level of vacancies is being seen in smaller, “mom-and-pop” stores, while strip malls are holding their occupancy levels the most. When analyzed by geography, the Northeast had the highest vacancy levels in the second quarter, with an average of 6.1%. Buffalo, New York, at 9.4% and New Haven, Connecticut, at 10.1% are the emptiest markets. The South has the lowest vacancy, at 5.4%.

See the Bisnow story for details on how much retail space is being absorbed nationally and significant store closures that are impacting many markets.

Cook County Board of Review Opens 2025 Appeals Session

June 2025 -

The Cook County Board of Review has opened the 2025 tax year session for appeals. Property owners may Pre-File an appeal of their 2025 property taxes with the Cook County Board of Review now or wait until the Assessor has finalized the property value and then file an appeal when the township's 30-day appeal period opens.

Reach out to one of our attorneys for more information.

North Triennial Reassessment Update

June 2025 -

The 2025 North Triennial Reassessment is underway and includes 13 townships: Barrington, Elk Grove, Evanston, Hanover, Leyden, Maine, New Trier, Niles, Northfield, Norwood Park, Palatine, Schaumburg & Wheeling. The North TRI accounts for approximately one quarter of the total assessed value in Cook County each year. Click here for more details.

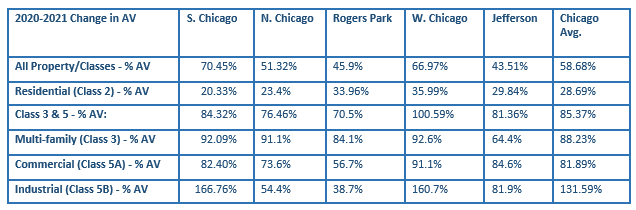

Our Property Tax Update section also delves into the common concern about how the property tax burden is allocated and how it impacts commercial versus residential assessments. In this article, we look at three issues: (1) that property taxes are a zero-sum game; (2) the state laws which govern property taxation in Illinois; and (3) the process by which property taxes are determined.

Multifamily demand remains strong at mid-year

June 2025 -

The supply-demand equation continues to favor landlords, but the multifamily market is experiencing some shifts heading into mid-year. Despite an uncertain economy and fluctuating financial markets, multifamily fundaments remain strong, according to a recent Yardi Matrix report. Connect Media reports that the average U.S. multifamily advertised rent across the country increased by $6 in May to $1,761, a 1% year-over-year increase.

Occupancy rates are dropping in some metros due to a strong supply pipeline, but the drop is slow and demand remains strong in key metros. Overall rent growth remains concentrated in the Northeast and Midwest, yet some markets that saw weaker performance recently—such as Denver, San Francisco, Dallas and Austin—recorded varying degrees of positive growth in May.

E-Commerce continues to drive Chicago industrial sector

May 2025 -

E-commerce continues to drive the industrial sector in Chicago and throughout the country, creating a positive picture for warehouse and logistics space utilization, according to a recent report from Commercial Edge. While trade tensions are creating some near term instability, the long-term outlook for industrial remains strong. Online sales continue to grow, reaching nearly 20% of overall retail sales and reinforcing the strong outlook for owners and investors in that property category.

In the Midwest, Chicago had the third highest average rent in the report, reaching $6.42 per square foot, behind the Twin Cities at $7.29 and Detroit at $7.24. Detroit showed the lowest vacancy rate (6.4%), with Chicago recording the highest (10.9%).

Chicago office market stabilizes in Q12025

April 2025 -

Chicago’s office market showed signs of stability in Q12025, despite a YOY uptick in the unemployment rate (to 5.1%). Cushman & Wakefield’s Market Beat report shows a steady labor pool and increasing employment in government, education and health services sector, along with dips in most other office related employment categories.

The West Loop and River North drove leasing demand in the CBD, which ended the quarter with 1.4 million square feet of new leasing activity. That figure represented a 28.9% decrease on a quarterly basis, however, showing the ongoing struggles in the office sector.

In the coming months, sublease availability is expected to stabilize as tenants reassess their shifting office space needs. And, trophy and top-tier assets, particularly in the West Loop and River North, will continue to outperform the broader market.

Click here for more.

Homeowner Exemption Applications Due April 21, 2025

March 2025 - Exemption applications for the 2024 tax year are available online and are due Monday, April 21, 2025. Exemptions are savings that contribute to lowering a homeowner’s property tax bill. The most common is the Homeowner Exemption, saving a property owner an average of $950 dollars each year, according to the Cook County Assessor’s Office. Exemptions are reflected on the second installment property tax bill. See the full list of exemptions here.

First Reassessment Township of North and Northwest Suburbs Opens for Appeals

March 2025 - The first reassessment township, in the triennial reassessment of the north and northwest suburbs, has opened for appeals. Property owners will receive a Reassessment Notice in the mail with important information about the new estimated Fair Market Value of the property. Property owners have until the date listed under “last file date” to file an appeal.

Click here for more details.

Chicago Ranks #4 for Office Building Conversions

February 2025 - There’s a lot of talk about converting older office buildings to apartments and recent data shows it is working in some markets, if the property is the right fit. Chicago ranked #4 on RentCafe’s list of top metros for conversions, with 3,606 projects in the pipeline.

RentCafe shows a big jump in these types of projects, from 23,100 nationally in 2022 to a record 70,700 planned for 2025. The top three were New York (8,310), Washington, D.C. (6,533) and Los Angeles (4,388). This is all good news for the office sector, but the key for investors and developers is finding properties that can be efficiently converted without costly structural changes or barriers to rezoning.

Retail Real Estate Market Update

January 2025 - The retail industry continues to adapt to shifting consumer needs and is set for another strong year in 2025, according to this Commercial Property Executive story. Necessity-based retail, such as grocery-anchored shopping centers are among the favored retail types due to their resilience. As the story notes, the migration to suburban markets and the influence of hybrid work are key factors that are changing retail patterns.