Property Tax Updates

June 2025

June 2025

March 2025

Homeowner Exemption Applications Due April 21, 2025

Exemption applications for the 2024 tax year are available online and are due Monday, April 21, 2025. Exemptions are savings that contribute to lowering a homeowner’s property tax bill. The most common is the Homeowner Exemption, saving a property owner an average of $950 dollars each year, according to the Cook County Assessor’s Office. Exemptions are reflected on the second installment property tax bill. See the full list of exemptions here.

March 2025

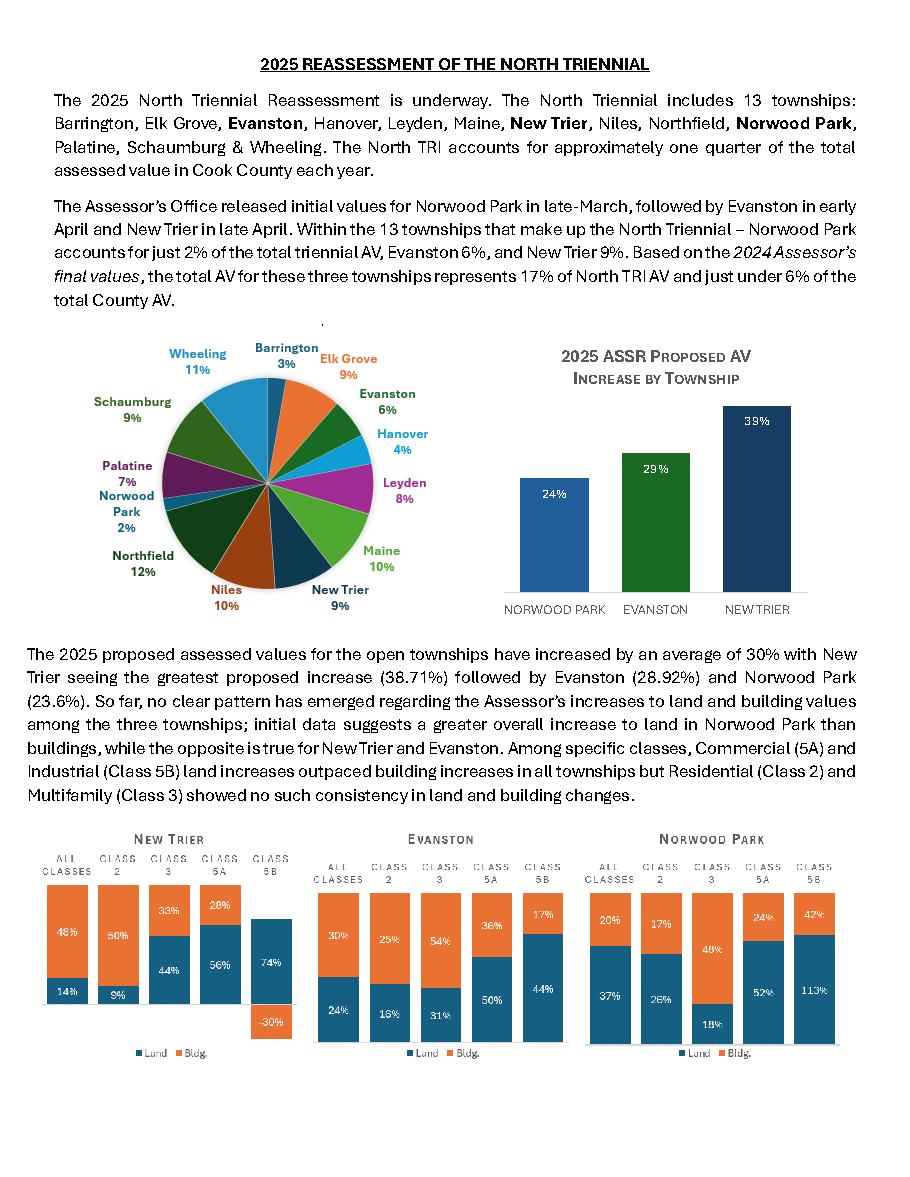

First Reassessment Township of North and Northwest Suburbs Opens for Appeals

The first reassessment township, in the triennial reassessment of the north and northwest suburbs, has opened for appeals. Property owners will receive a Reassessment Notice in the mail with important information about the new estimated Fair Market Value of the property. Property owners have until the date listed under “last file date” to file an appeal.

Click here for more details.

January 2025

December 2024

November 2024

October 2024

September 2024

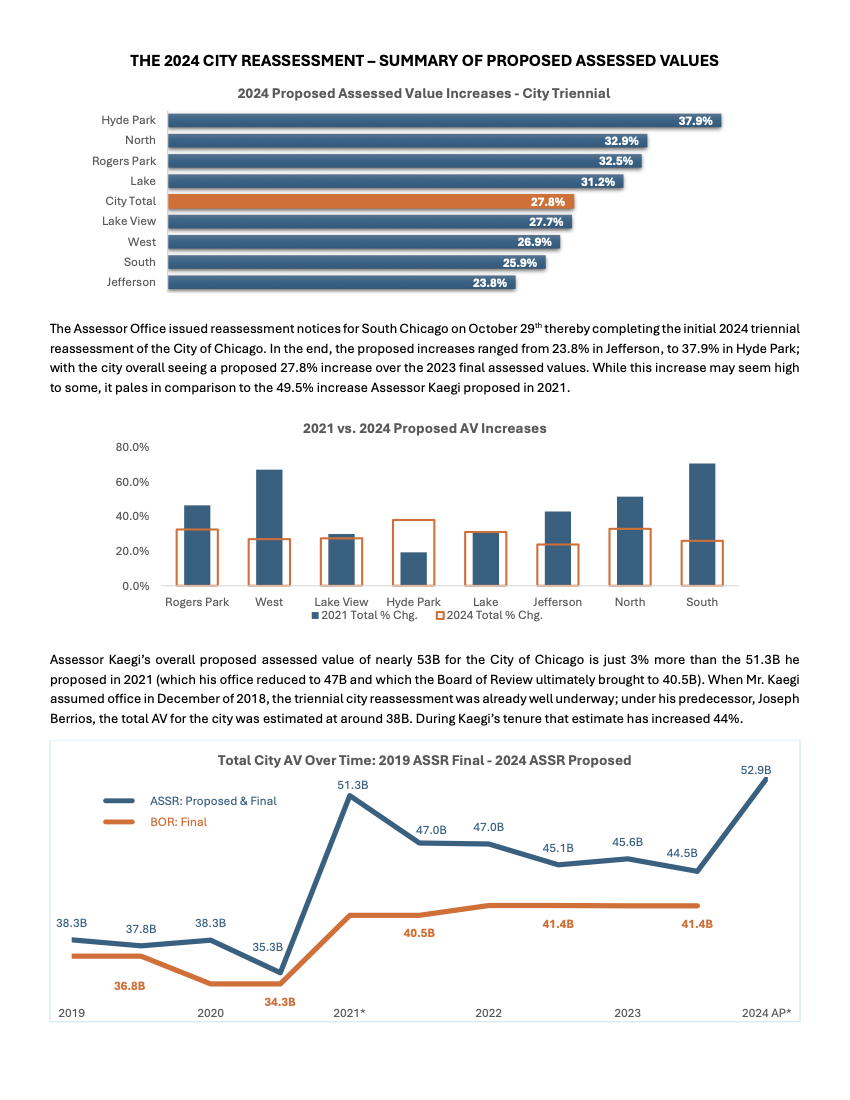

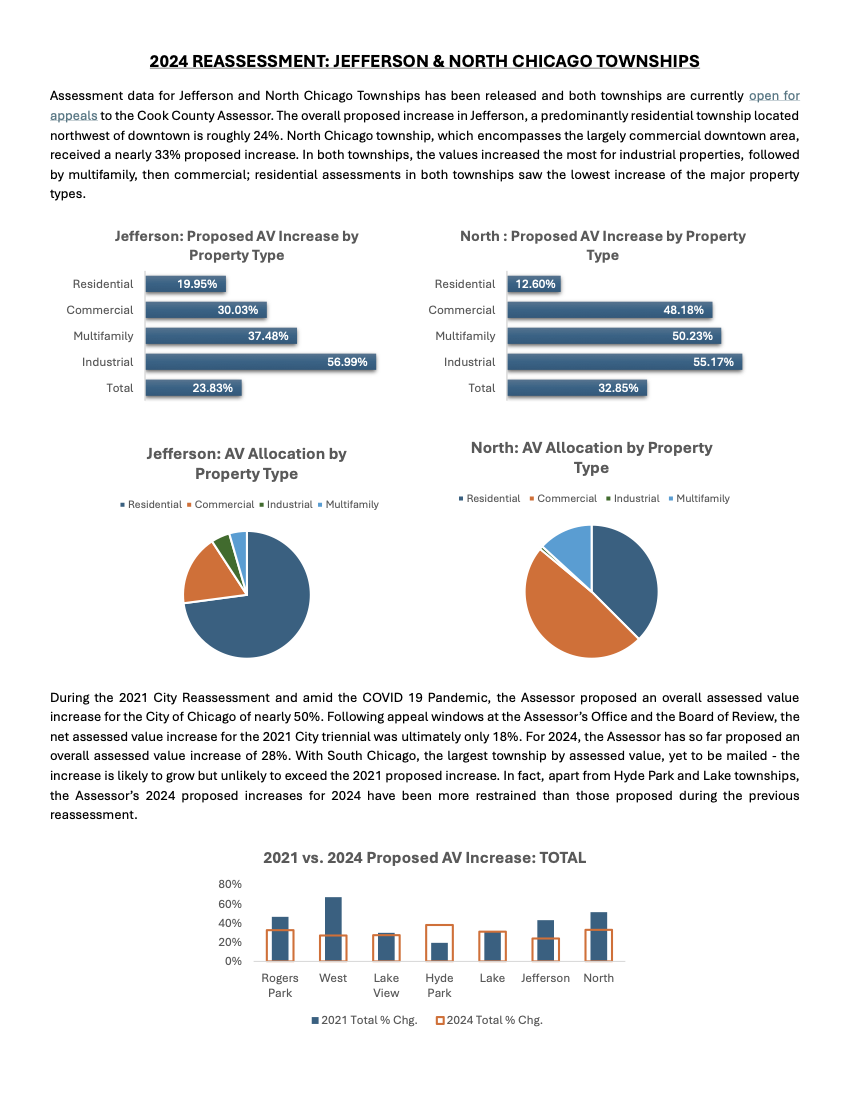

Fall Update on 2024 Triennial Reassessment

O’Keefe Lyons & Hynes is continuing to analyze the data to provide our clients with a comprehensive look at Chicago’s triennial reassessment. See below for the latest details on:

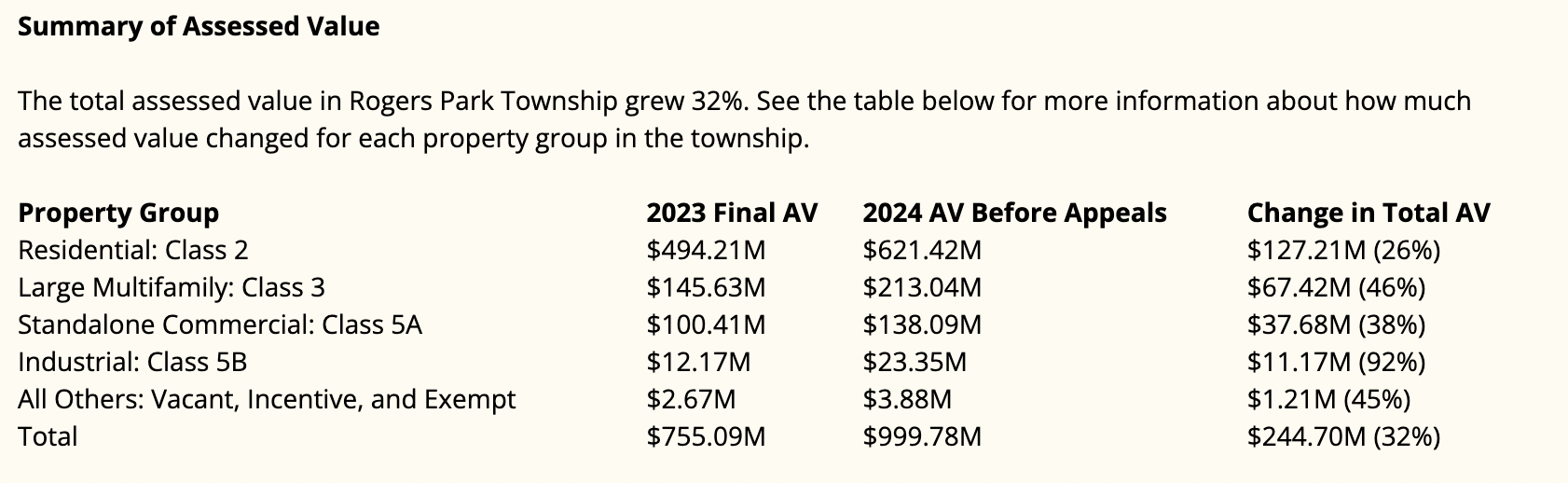

Rogers Park

Overall, the 2024 proposed assessed value for Rogers Park is approximately 32% higher than the 2023 final value. Residential property (Class 2) increased by nearly 26%, while multifamily (Class 3) properties saw a proposed increase of almost 50%. Commercial property (Class 5a) increased by around 33% and industrial properties (Class 5b) saw a nearly 97% increase. Click here for more.

West Chicago

As with Rogers Park, we examined increases applied to the land and improvements separately and noted an imbalance. Notably, as observed in Rogers Park, the substantial proposed land increases for 2024 correspond with a lack of land increases during the prior City triennial reassessment in 2021 when multifamily, commercial, and industrial land values went essentially unchanged. Click here for more.

Lake View, Hyde Park and Lake

As with Rogers Park and West, the 2024 proposed assessment increases to multifamily, commercial and industrial land in Hyde Park, Lake, and Lake View far exceeded those proposed in 2021. However, unlike Rogers Park and West which saw greater increases to land values overall in 2024, the percentage increase proposed for improvements in Hyde Park, Lake, and Lake View exceeds the increases applied to the land. Click here for more.

July 2024

Board of Review Announces Appeal Window for Five Townships

The Board of Review has announced the appeal window for the first five townships – Riverside, River Forest, Norwood Park, Rogers Park and Evanston. They will open July 22, 2024 and close August 20, 2024. Property owners may pre-file an appeal of the 2024 property taxes during this period or wait until the property value has been finalized by the Assessor and file when the township is open for appeals.

The remaining townships will open for assessment appeals as the Board receives the certified values from the Assessor.

July 2024

Lake View Township 2024 Initial Assessments Released

The Lake View Township 2024 initial assessments were released on July 2, 2024 and the deadline to file an appeal is August 14, 2024. Other upcoming appeal deadlines include: Hyde Park, opening in late July; and Lake, opening in late August. Dates for North Chicago and South Chicago have not been determined.

June 2024

Second Installment Tax Bills for 2023 Posted to Treasurer’s Website

Second installment tax bills have been posted to the Cook County Treasurer’s website, and can be accessed by clicking on the link below and entering your PIN. The site provides information on recent tax bills, property tax exemptions and other details on the property and its taxing history. Payments can be made online. Bills are due August 1, 2024.

https://www.cookcountytreasurer.com/setsearchparameters.aspx

June 2024

2023 Tax Rates Now Available on the Cook County Clerk’s Website

The Cook County Clerk’s office has published the 2023 tax rates for the various townships. Click here for a list of the rates or visit the main property tax page for additional information.

June 2024

Second Installment of 2023 Property Taxes Likely Due August 1

Based on the Cook County Board of Review finalizing 2023 appeals and The Illinois Department of Revenue publishing the final 2023 Multiplier/Equalizer for Cook County, tax bills will likely be distributed in the next few weeks, with the second installment for 2023 property taxes likely due Aug. 1, 2024.

May 2024

West Chicago Township 2024 Initial Assessments Released

The Assessor’s Office has released a list of townships in Cook County and the reassessment mailing dates and timeframe for appeals. Cook County follows a triennial assessment cycle during which property owners can file appeals with the Assessor’s Office and the Board of Review. The deadlines vary by township and can be found here.

May 2024

Final 2023 Cook County Multiplier Announced

The Illinois Department of Revenue (IDOR) announced its final 2023 property tax equalization factor for Cook County. The 3.0163 equalization factor, often called the multiplier, is designed to help achieve uniform property assessment throughout the state.

The equalization factor for each county is determined by comparing a three-year period and factoring in the selling price of individual properties to the assessed value placed on those properties by the county assessor. According to the IDOR, if the median level of assessment for all property in the county varies from the 33 1/3 percent level required by law, an equalization factor is assigned to bring assessments to the legally mandated level.

The three-year average level of assessments (weighted by class) for Cook County property is 11.05 percent. The Department calculated the multiplier to bring the average level of assessments to the required 33 1/3 percent level by dividing Cook County's three-year average of 11.05 into 33.33. Click here for more.

May 2024

Board of Review Re-Review and Decision Dates Announced

The Cook County Board of Review has announced its final Re-Review and Decision Dates for 2023 assessments. These dates cover 38 townships and include upcoming dates in May for the following: North and South (May 1), Niles and Proviso (May 3) and Lake, Northfield and Worth (May 5). Check out the link for more details.

April 2024

Update on 2024 City of Chicago Triennial Reassessment

Property owners are preparing for upcoming changes in their tax bills, as the 2024 Triennial reassessment gets underway in the City of Chicago. As each township “opens,” residents will receive an updated notice with the property’s estimate Fair Market Value. Note that updated values take an extra business day to appear online from the mail date. And, as townships in the city are certified, updated values also take an extra business day (from the “Certified” date) to appear online.

Here's an overview of dates and deadlines.

Questions about your commercial or residential property taxes? Feel free to reach out to one of our attorneys:

Whitney Carlisle

Brian Forde

Kevin Hynes

Chris Beck

March 2024

Rogers Park Initial Assessments Released

The Cook County Assessor’s Office has released the initial assessments for Rogers Park Township, covering residential and commercial properties. This is the beginning of the City of Chicago’s triennial reassessment. The total assessed value in the township rose by 32%, led by significant increases in assessed valuations for industrial, multi-family and other commercial classes. Valuations for residential properties grew but at a lower rate, according to the Assessor’s Office.

The median sales price for single family homes in 2023 was $450,000 in Rogers Park.

Appeals for the township can be filed until April 17, 2024.

See the Assessor’s Office website for more details.

Image courtesy of the Cook County Assessor’s Office

March 2024

Homeowner Exemption Applications due April 29, 2024

The Cook County Homeowner Exemption, which averages $950 each year, can help lower a property owner’s tax bill. New homeowners and those who need to reapply can do so by completing the online application, which is due April 29, 2024. The website below allows homeowners to review which exemptions are currently being applied to their property. The tax savings from exemptions are reflected on the second installment tax bill.

Click here for more.

January 2024

First Installment Tax Bills Due March 1, 2024

Cook County property owners can visit www.cookcountytreasurer.com to view, download and prepay their First Installment 2023 property tax bills, which are due March 1, 2024.

Property tax bills are divided into two annual installments. The first, which is 55 percent of the previous year’s total tax, is due March 1, 2024. Here are the steps to download your tax bill and make a payment:

- Select the blue box labeled "Pay Online for Free"

- Enter your address or 14-digit Property Index Number (PIN)